What if you could solve some of your biggest challenges

You get a future-proof solution that’s upgraded on a continuous basis and complies with all legal requirements

The total cost of operating, maintaining and updating the claims system decreases by 50% compared to traditional claims systems

Your complete end-to-end core claims system

Your complete end-to-end core claims system

With ClaimsCORE you can resolve claims faster, exceed customer expectations, and spark innovation with one of the most modern claims management core systems in the P&C insurance market today. Retain your customers by meeting their expectations for quick, convenient customer service when the damage has occurred. Increase productivity with automated processes, achieve faster cycle times and experience less leakage.

Optimize the claims journey from A-Z

Automate and optimize workflows

Achieve faster claims cycle time

Deliver streamlined claims settlement

Provide smooth and transparent customer experience, resulting in a higher NPS

CUSTOMER CASE

"We had reached a point where it made more sense to invest in one central system compared to working in several different systems. After researching the market for possible solutions, the choice fell on ClaimsCORE – a SaaS-based, pre-configured claims platform with the possibility of customisation."

Why ClaimsCORE?

Quick implementation

Months instead of years. The solution is 90% ready to use.

Low total cost

Up to 50% savings with multi-tenant SaaS. Includes operation, country layer and standard setup.

Developed by Nordic claims nerds

Nordic experts in digital claims. Best-in-class processes and user friendliness

Meet and exceed customer expectations, and boost productivity

Meet and exceed customer expectations, and boost productivity

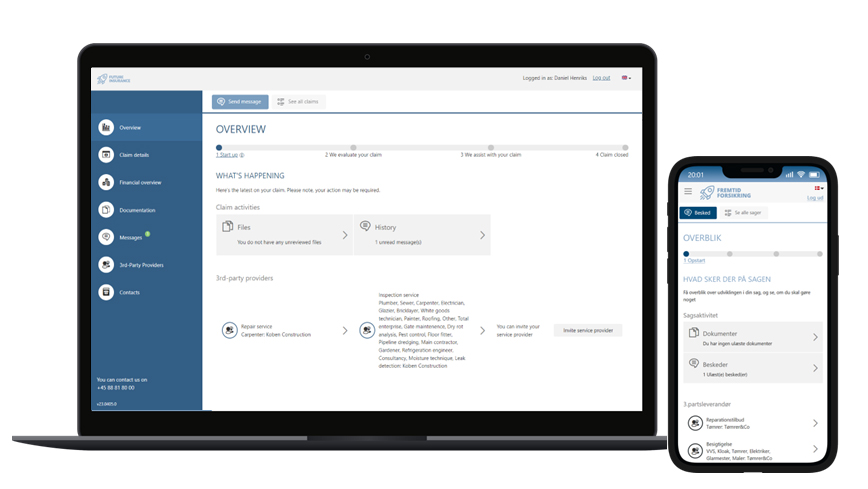

Ensure a smooth, user-friendly digital claims experience for your self-service customers and improve efficiency for your claim handlers, allowing them to provide faster and more personal service to your customers.

- Change FNOL into a seamless customer experience

- Empower your customers with a transparent, fast and easy claims platform for dialogue and more self-service opportunities in their preferred channels

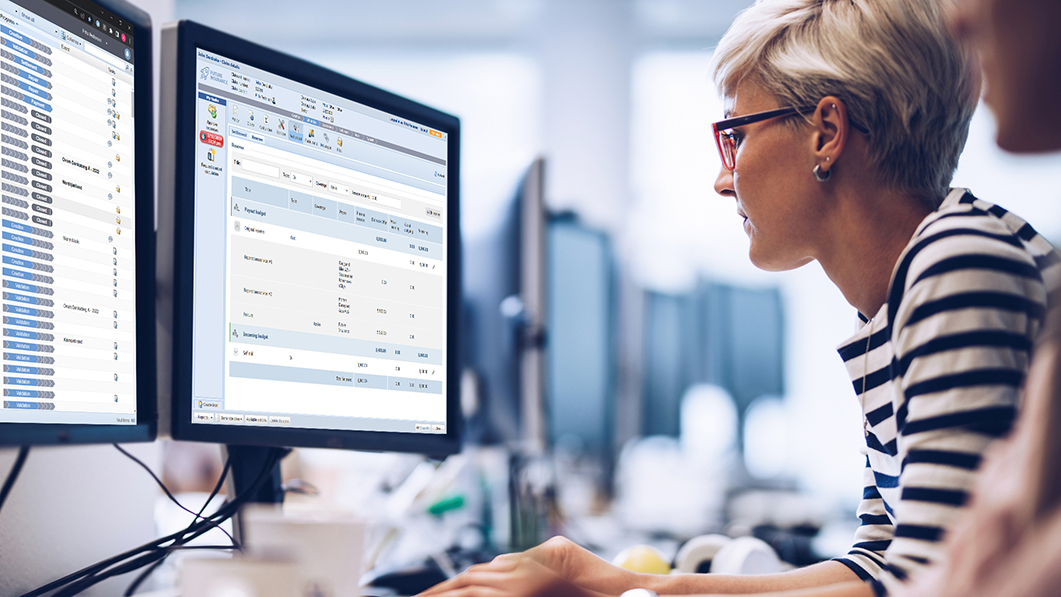

- Allow your claims handlers to take advantage of guided automated processes to enhance service, prevent leakage, and boost productivity

Accelerate innovation with a fast, compliant and future-proof claims handling platform

Accelerate innovation with a fast, compliant and future-proof claims handling platform

Accelerate innovation and turn ideas into powerful results with groundbreaking cloud technology supporting the entire insurance claims cycle from A-Z.

- Extend and enhance functionality capabilities of your claims operation with a wealth of different, optional apps available

- Offer your customers or partners embedded insurance and white label options, all tailored to their specific needs, and preferred look and feel

- Benefit from a future-proof claims handling platform where maintenance, compliance and hosting are included in your subscription, so you can focus on your business

Fast implementation, streamlined processes, and shorter turnaround time

Fast implementation, streamlined processes, and shorter turnaround time

“Compared to development projects that can easily drag on for years, we went live with the CORE cloud-solution in a matter of months. We streamlined processes internally, increased the quality of claims processing and ensured a shorter turnaround time. What’s more, the system gives us room to focus all our efforts on the member experience.”

Henrik Boysen, CEO

Popermo Forsikring G/S

A standard solution based on best practice

The CORE solution is ready to use. Using our best practices from over 30 insurance companies, we have made it as easy as possible to get started. The solution is pre-configured, so you don’t have to spend IT resources on coding. At the same time, the solution is configurable so you can adapt it to your needs:

Easy and inexpensive access to a state-of-the-art claims management system

Hosting is all taken care of - so you won't have to worry about system operation and ongoing maintenance

We ensure that the solutions comply with all regulatory and data security requirements

Implemented and fully operational claims system in 6-12 months

No underinvesting in claims management and surprises related to costs

One fully integrated platform for all users (multi-country, multi-language and multi-currency) on all types of claims including self service capabilities for end users

Extensive data displayed in dashboards and delivered to own data warehouse

An up-to-date platform that is always on the latest version (weekly updates) with high SLA levels

ClaimsCORE Functionality

ClaimsCORE supports all the steps in the claims handling process, both customer-facing and on the administrative level.

A trusted and reliable SaaS claims system

EUROPEAN INSURERS

IN ANNUAL CLAIM PAYOUTS

TOTAL HANDLED CLAIMS

We develop and maintain Denmark's most comprehensive ecosystem.

The built-in ecosystem in ClaimsCORE is a digital gateway to relevant public IT systems, selected service partners, and other digital services. We are always ahead of requirements and adapt automatically, allowing you to focus all efforts on your core business.

Industry standard

For example SOS Rejseforsikring, Dansk Autohjælp, F&P EDI (Opsigelse, Regres, Skadehistorik og Panthaver), PBS - NETS, Naturskadeafgift, DFIM and FORSI/AUTOTAKS

Country standard

For example CPR/CVR opdatering, CPR-registeret, E-indberet, DMR, BBR, DAWA and Datafordeler

3rd party (access via portal)

For example damage service companies, +10.000 workshops, +5.000 craftsmen, +20.000 suppliers via Nemhandel, Navision, PowerBI, Taksatorringen and AutoIT

A unique SaaS delivery model

A unique SaaS delivery model

Our delivery model is multi-tenant SaaS. That means you share the solution with other insurance companies and enjoy economies of scale. The solution is preconfigured with country layers but can be adapted to your exact needs. Implementation takes months instead of years, saving significant costs.

- Pre-configured

- Built-in country layer

- Multi-tenant SaaS

Explore our other solutions

Scalepoint CORE

A complete and intuitive core system (PAS), which digitises all policy and claims processes and can easily be customised to your business.

PolicyCORE

Make it easy and efficient to develop new products, as well as sell and administer policies. A SaaS-based policy system that digitises crucial sales and customer processes, thereby optimising your business and enhancing the customer experience.

Contact us. We'd 🤍 to help!

Your questions and comments are important to us. Select a topic below, or reach us by email. We've got everything covered for your needs.