A radically improved customer experience

Scalepoint was founded with a clear goal to digitize the claim process, making it easier and faster to determine the settlement amount and buy replacements – and thereby radically improve the customer experience. This customer-centric focus has been a priority ever since and still is – why we say, “We help insurance companies help their customers”.

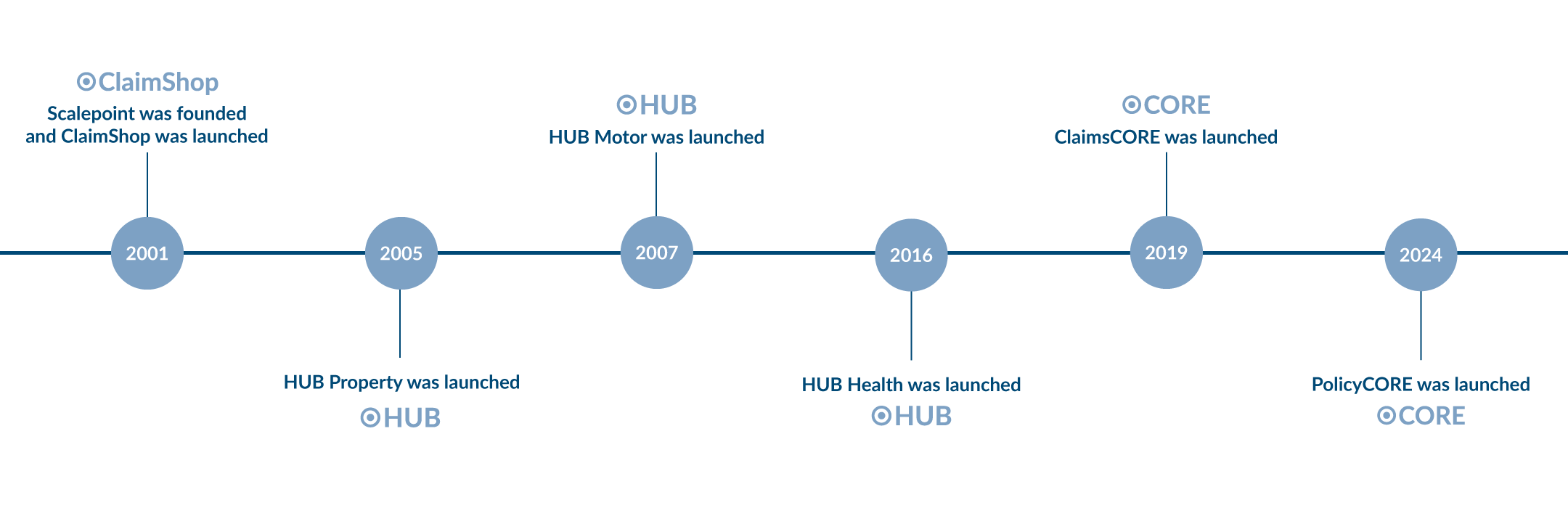

Our concept was a success from the get-go, as it automated the processing of simple insurance cases at a high volume and our webshop could consolidate the purchasing power of multiple insurance companies. For the insurance companies this meant an elevated claimant experience and millions in annual savings from lower costs – this still holds true today.

Automating the claim process was a bit of revolution in 2001 (to put it mildly), as the industry was characterized by a lack of innovation and digitization. A heavy case load, manual processes and expensive IT development projects was the reality for the industry. For Scalepoint’s customers that is no longer the case, as they benefit from cloud-based solutions with low implementation and maintenance cost, while still being tailored to their specific needs. Since 2019 this has included all types of claims with ClaimsCORE.

In 2024, we introduced PolicyCORE, extending beyond claims to also offer automation of the policy administration and sales processes. This new solution, combined with our claim’s expertise, brings insurers a full-fledged insurance system that adds automation to the whole insurance process, creating exceptional value for insurers and their customers alike. Exciting times ahead.

In 2025, we became part of Total Specific Solutions (TSS), giving us a solid and long-term foundation to accelerate innovation across our solutions. For our customers, this means greater stability, enhanced development capacity, and a continued focus on creating efficient processes and strong customer experiences. At the same time, we remain an independent company with the same mission: helping insurance companies help their customers.